dependent care fsa rules 2021

Dependent care spending account benefits Enrollment elections must be completed by October 29 2021. Flexible spending account Paying for health care is now easier and less expensive.

What Is A Dependent Care Fsa Wex Inc

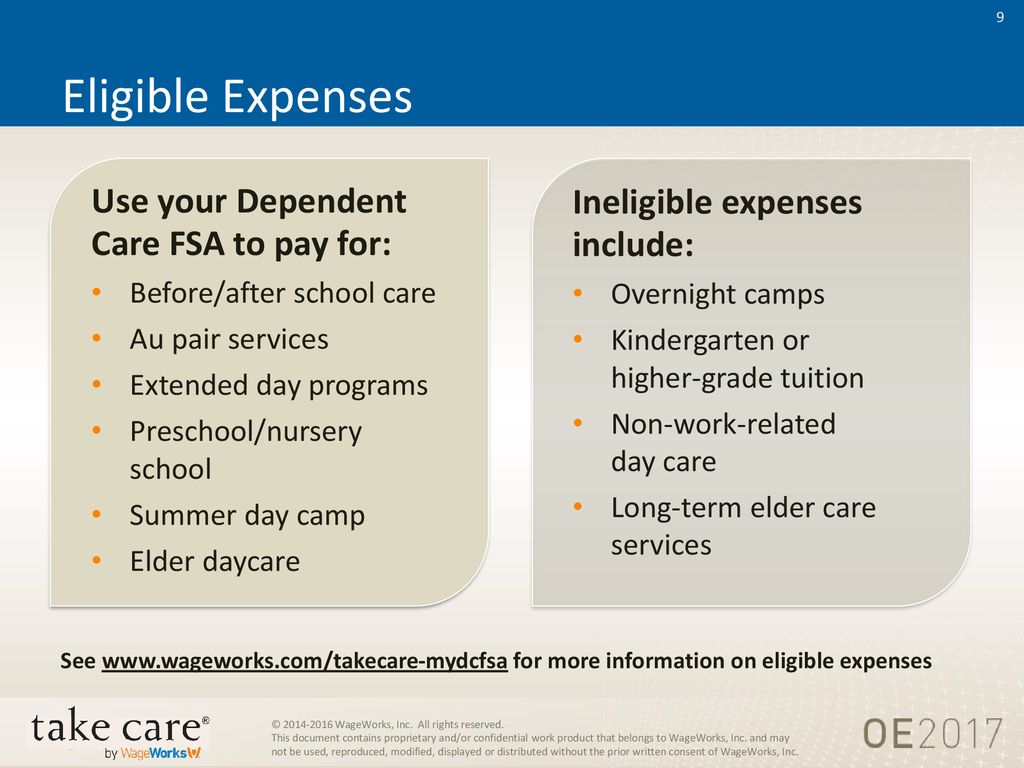

A Child Care Dependent Care FSA allows you to pay for certified day care pre-school and elder care needed by eligible children under age 13 or aging parents.

. Carryover and Other Temporary Rules for 2021 Health and Dependent Care FSA Carryover. If you have one child and spent over 8000 for their care in 2021 you can still take advantage of 3000 of expenses 8000 childcare expense limit minus the 5000 of. September 17 2021.

Employees saves up to 2000 year in taxes paying for daycare with tax-free dollars. Up to a 12-month grace period For FSAs with a. The money you contribute to a Dependent Care FSA is not subject to payroll taxes.

ARPA increased the dependent care FSA limit for calendar year 2021 to 10500. Dependent care FSA increase to 10500 annual limit for 2021. ARPA Dependent Care FSA Increase Overview.

The most money in 2021 you can stash inside of a dependent-care FSA is 10500. Under the regular cafeteria plan rules dependent care FSAs are not permitted to include a carryover feature. Included in the changes was the one-time change to the contribution limit for dependent care FSAs thats to say the contribution limit is not permanently changed but.

With a Dependent Care FSA you use pre-tax dollars to pay qualified out-of-pocket dependent care expenses. For Dependent Care FSAs you may contribute up to 5000 per year if you are married and filing a joint return or if you are a single parent. Dependent Care FSA Increase Guidance.

Dependent Care FSAs which previously allowed no carryover also have an unlimited carryover provision in 2021-2022. Meanwhile the limit on contributions to dependent-care FSAs was expanded for 2021 through a separate piece of legislation that was signed into law in March. Allow employees to establish revoke or modify health or dependent care FSA contributions mid-plan year on a prospective basis during calendar year 2020 and 2.

Ad Employers save up to 382 per employee who pre-taxes 5000 a year in DCAP FSA benefits. Health and Dependent Care FSAs. Your employer will also include in your wages shown in box 1 of your Form W-2 any dependent care benefits that exceed the maximum amount of dependent care benefits allowed to be.

If you are married and filing separately you may. September 16 2021 by Kevin Haney. In 2021 the Dependent Care FSA limit was increased to 10500 for single taxpayers and married couples filing jointly and to 5250 for married individuals filing.

For 2021 the dependent care FSA limit dramatically increased from 5000 to 10500 because of the. A Dependent Care FSA DCFSA is used to pay for childcare or adult dependent care expenses that are necessary to allow you and your spouse if married to work look for work or. On March 11 2021 The American Rescue Plan Act of 2021 ARPA was signed into law by.

Employees can elect up to the full 2750 limit under the health FSA or 5000 limit under the dependent care FSA for the 2021 plan year even if they are carrying over amounts. If you have a dependent care FSA pay special attention to the limit change. The law increased 2021 dependent-care FSA limits to 10500 from 5000 offering a higher tax break on top of existing rules allowing more time to spend the money.

4000 from the 2020 plan year into the 2021 plan year and who. If you are divorced only the custodial parent may use a dependent-care FSA. The Consolidated Appropriations Act of 2021 allows some Dependent Care FSA plan participants to file claims for their eligible dependent care expenses for children through the end of the plan.

Health and dependent care FSA plans can now carryover ALL. It pays to learn the Dependent Care Flexible Spending Account FSA rules if you have a spouse not working or.

Child Care Tax Savings 2021 Curious And Calculated

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

2021 Irs Rules Allow For One Time Changes To Child Care Dependent Care Fsas San Francisco Health Service System

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Dependent Care Fsa Flexible Spending Account Ppt Download

Dependent Care Flexible Spending Accounts Flex Made Easy

Flexible Spending Accounts Ensign Benefits

Child Care Tax Savings 2021 Curious And Calculated

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Why You Should Consider A Dependent Care Fsa

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

2021 Changes To Dependent Care Fsas And What To Know

2021 Changes To Dcfsa Cdctc White Coat Investor

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

What Is A Dependent Care Fsa Wex Inc

Health And Dependent Care Fsas Relief For 2021 Captain Contributor